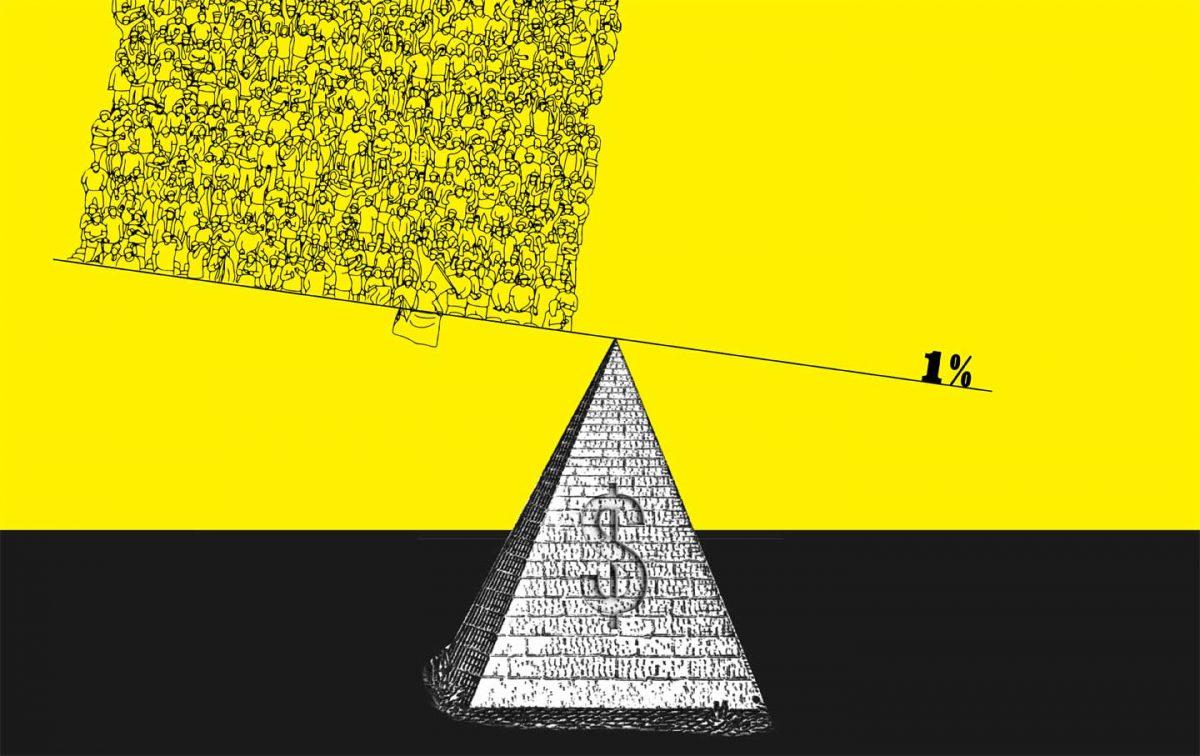

The Ever-Growing Gap in Income and Wealth

Since the publication of my book Survival of the Richest in July 2017, the bleak numbers I documented in terms of disparity of wealth have only grown worse. A recent paper from the Economic Policy Institute found that the top 1 percent of American families made an astounding 26.3 times what families in the 99 percent below them did in 2015. The study counted those making just under $422,000 pre-tax as being in the One Percent. Considering all those who earn a decent to very solid income—say $80,000-400,000—that are included in that 99 percent, it is truly sobering to consider that the average salary for that 99 percent is just over $50,000 per family. https://www.cnbc.com/2018/07/19/income-inequality-continues-to-grow-in-the-united-states.html

The tax cuts Donald Trump and the Republicans passed, which benefit the wealthiest Americans the most, will certainly aggravate this growing disparity. According to the Center on Budget and Policy Priorities, the wealthiest fifth of Americans will see 70 percent of the bill’s benefits, with the One Percent getting 34 percent. The 2018 World Inequality Report delineated how the income and wealth gap we see in America does not exist in Europe. The report contrasted the stark drop in the poorest Americans’ share of wealth with the sharp rise in wealth share for the One Percent, in the years 1980-2016. This same pattern wasn’t seen in Europe. In the words of those who wrote the report: “The income-inequality trajectory observed in the United States is largely due to massive educational inequalities, combined with a tax system that grew less progressive despite a surge in top labor compensation since the 1980s, and in top capital incomes in the 2000s. Continental Europe meanwhile saw a lesser decline in its tax progressivity, while wage inequality was also moderated by educational and wage-setting policies that were relatively more favorable to low and middle-income groups.” https://www.vox.com/2018/7/29/17627134/income-inequality-chart

Again showing how the above statistics are even bleaker for the majority of Americans, a UC Berkeley study found that the wealthiest 10 percent of the country have some nine times as much income as the bottom 90 percent, with those in the rarified air of the One Percent averaging a stunning 40 times more income. And the 0.1 percent- those that Huey Long was targeting eighty years ago before he was assassinated- takes in an incomprehensible 198 times the income of the bottom 90 percent. https://inequality.org/facts/income-inequality/

While those in the One Percent can lose hundreds of thousands in stop plunges, 60 percent of Americans wouldn’t be able to handle an unexpected expense of $1,000. This shocking conclusion came from a study this month by Bankrate. https://www.cnbc.com/2019/01/23/most-americans-dont-have-the-savings-to-cover-a-1000-emergency.html That was even worse than just a year earlier, when GoBankingRates found that 58% of Americans had less than $1,000 in savings. https://edubirdie.com/blog/americans-have-less-than-1000-in-savings To understand how little those in the bottom half of America now have, those with incomes over $160,000 have an average balance of $50,000 in savings. https://smartasset.com/checking-account/savings-account-average-balance

When the media breathlessly reports on the fluctuations of Wall Street, consider that, according to a 2017 study by New York University economist Edward Wolff, less than 14 percent of Americans directly own stock in any company. For many, that market can feel as remote as a high-stakes game, prompting a segment of risk-takers to explore the best non GamStop casinos in search of quick gains—a pursuit not unlike the allure of sudden windfalls on Wall Street. And less than half of Americans own any stock indirectly, through 401K plans and the like. The bottom 60 percent of households own just 1.8% of American stock. The One Percent, meanwhile, owns over 40 percent. The bottom 80 percent of American families own a meager 7 percent of stock, even with their retirement accounts factored in. Think about that; the lifeblood of American capitalism—the stock market—is essentially meaningless to the lives of more than half of the population.

The statistics that illustrate this tragic economic situation are everywhere. Jeff Bezos, now supposedly the world’s wealthiest individual, earns the annual salary of Amazon’s lowest paid employees every 11.5 seconds. This is even after recently agreeing to raise the minimum wage of his US working staff to $15 an hour. Prior to that move, which earned Bezos glowing pubic adulation from the likes of Bernie Sanders, he was making more than his average worker every 9 seconds. Even after the raise, the median salary for an Amazon worker is just $30,000. In just the last year, Bezos attained his top ranking as his wealth increased by an unfathomable $82.6 billion. Bezos’ net worth is 2,687,125 times the median US household income and equal to almost 1 percent of the gross national product. https://www.bloomberg.com/billionaires/profiles/jeffrey-p-bezos/ The average salary for Microsoft employees is roughly the same modest figure, meaning the world’s formerly richest man, Bill Gates, is not exactly sharing the wealth, either.

The ratio of CEO to average employee pay rose from a fairly reasonable 25 to 1 in 1975 to 312 to 1 by 2017. No person is worth 315 times what another person is worth. Half of America has almost no wealth, and thirty percent above them- what’s left of the disappearing middle class- doesn’t have much of the pie. That’s not a First World economy.

One of our country’s most important freedoms is that of free speech.

Agree with this essay? Disagree? Join the debate by writing to DailyClout HERE.