Opinion: “Vastly Expensive Dem-Driven “Rescue Act” Showcases Vaccines, Tax Credits, Child Poverty”

As I completed my read of The American Rescue Plan Act of 2021, with its price tag of $1.9 trillion, I was filled with mixed emotions. As a fiscal conservative, I winced at the cost. When this bill passes, Congress will have authorized a total of $5.3 trillion in COVID relief. This will pile onto an already hefty public debt of $26.9 trillion.

I also thought of the damage caused, especially to the working and middle class and small business, during the last recession and now, again, in 2020-2021. As many as 25.5 million Americans are unemployed or underemployed and desperate. The income gap has done nothing but grow between the haves and the have-nots.

But I also considered this bill’s laser focus on funds for public health and the least advantaged Americans, and the urgency it places on the re-opening of schools, the economy, and small businesses. The American Rescue Plan Act is all about growth from the bottom up. It is, simply put, a bill with a heart. And it may deliver the best chance yet of kicking the economy and employment back into pre-pandemic gear.

Ironically, the 2017 Tax Cut and Jobs Act (a.k.a. H.R. 1), touted by largely Republican supporters, had also been a bill expected to accelerate economic growth and create new jobs. But in fact it did neither. Rather, it ended up enriching large corporations and the wealthy and contributing to an even larger deficit and negative impact to the Nation’s budget of $1.9 trillion.

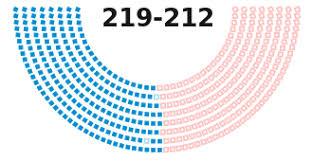

H.R. 1319 is in contrast, a very popular bill among Americans and the Nation’s mayors who “know a thing or two because they’ve seen a thing or two” about what’s happening in the real world. Surveys show that 76% of Americans support passage of the legislation, including 60% of Republican voters, 71% of independents and 89% of Democrats. And 71% of those who earlier received stimulus payments say the money was very important or somewhat important to their near-term financial situation. In addition, the Nation’s mayors, as represented by the transpartisan the United States Conference of Mayors applauds its passage. Finally, despite strong objections by the GOP, not one of whose members voted for this bill, 425 GOP mayors have come out in support of it, citing that the aid would enable them to continue to fund basic services such as police, fire, schools and emergency services.

Despite this popularity at the nonpartisan grassroots, opposition among conservatives leaders has been harsh: these have included criticisms ranging from assertions that it includes wasteful spending on Democrats’ pet/pork initiatives, to claims of state and local aid disproportionately benefiting “Blue” states over “Red” states, to the notion that the economy is improving and only lockdowns and supply constraints are hindering progress, and much more. Further, Republican leaders say that they were shut out of negotiations due to the reconciliation process, a special process that makes it easier to pass bills – a simple majority is required, versus 60 votes in the Senate; at which point this majority pushes the writing of the bill and its components to committees. Both parties have used “reconciliation” and it was last used to pass the dubious 2017 Tax and Jobs Act mentioned above.

The official Bureau of Labor Statistics (BLS) unemployment reports recently showed 10.1 million unemployed. But this official calculation is deceptive. Because the report is derived from a survey, to be classified as unemployed you have to have been looking for a job in the past four weeks. And the numbers do not take into account the employed whose hours or pay have been cut. When taking into account those that are unemployed, underemployed and those who have given up looking, as mentioned above, a full 25.5 million people – 15% of the work force – are still negatively affected by the pandemic from an employment perspective. This is comparable to the 2nd highest rate of unemployment in U.S. history, when it remained above 14% at various points during the Great Depression, from 1931 to 1940.

For those of us who are doing better, it is hard to imagine how bleak it really is for those 25.5 million people. For wealthier Americans, stock portfolios have been rising and they are pocketing savings from the reduced costs of working as our commuting costs have dwindled to zero. Industries such as banks and finance, technology, healthcare providers and telehealth services, cleaning, delivery and tutoring services, alcoholic beverages and liquor stores, grocery stores, food packaging and distribution, cleaning suppliers, game companies, fitness equipment and more, are doing well, maybe even better in this crisis.

But those who are self-employed, small business owners, or who worked in travel, transportation and leisure, live venue entertainment, music and motion picture, restaurants, movie theaters, construction, support jobs for mining and oil and gas extraction, laundry, dry cleaning and personal service, jobs manufacturing food, clothing and other goods, are struggling. It doesn’t matter how hard they try: many cannot find a job. Some are making difficult transitions to new jobs and new skills and that takes time. However, those that are unemployed or have dropped out of the work force, given up looking or simply cannot work for other reasons – i.e. children or elderly at home — are at historic levels. And employment always lags after the reopening of the economy. Hence the unemployed will have to wait longer as the economy opens back up.

I have cited in previous blogs that prior bills did not cover the real needs of schools and families with rental/mortgage assistance and more – not even close. This bill, however, does go the distance and adds real assistance to these sectors to cover these shortfalls as well as providing tax credits and other provisions for the lowest income Americans such that their after-tax income will grow. As an example, The Tax Policy Center found that 70% of the tax provisions in the bill will benefit households making under $91,000 per year. For households making under $25,000, the bill would cut their taxes by an average of $2,800, boosting their after-tax income by 20%. And low-income households with children would see an average tax cut of about $7,700, boosting their after-tax income by 35%. Middle-income households will also see an average tax cut of about $3,350, and this would increase their after-tax income by 5.5%.

Also, while the GOP fought hard to exclude provisions for State and Local assistance in prior bills and in this one, education, municipal and state worker unemployment is at a higher level than the Nation’s average. While the arguments for and against state and local aid are strong on both sides of the aisle, history has shown that state and local governments put a drag on the recovery in the last down-turn, taking years to catch up with the private sector. This bill will help cities and states maintain basic services for police, fire and emergency services and help them accelerate their reopening.

So, what is in this bill that is so important to the recovery of the economy? See below.

Selected Highlights From the American Rescue Plan of 2021

| What | How Much | Description |

| Stimulus Checks | $424 billion | $1,400 per person for individuals with up to $80,000 in adjusted gross income (phasing out between $75K-$80K), or families with up to $160,000 in adjusted gross income (phasing out between $150K-$200). These are lower brackets from previous stimulus bills. Accordingly, fewer Americans will receive a stimulus check in this go around, about 12 million adults and 4-5 million children. |

| State and Local Aid | $350 billion | States and the District of Columbia would receive $195.3 billion, while local governments would be sent $130.2 billion to be divided evenly between cities and counties. Tribes would get $20 billion and territories $4.5 billion. $10 billion is put toward infrastructure projects. |

| Unemployment Insurance | $246 billion | Extends the booster payment of $300 to September 6th. Benefits were to expire between March 14th and April 15th. Expands unemployment from 50 weeks to 74 weeks, and the Pandemic Emergency Unemployment Compensation (applies to freelancers, independent contractors and gig workers) program to 48 weeks, from 24 weeks. And, up to $10,200 of unemployment benefits received last year will be tax-free for households with incomes less than $150,000. It would also extend tax rules regarding excess business loss limitations for one additional year, through 2026. |

| Tax Credits, Aid, and Child Care For Families | $219 billion | $143 billion in tax credits. $39 billion to childcare providers. Expands child tax credit, child-care tax credit and earned income tax credit. The child tax credit goes from $3,600 for each child under 6 and $3,000 for each child under age 18. The credit would also become fully refundable so more low-income parents could take advantage of it. Nearly $15 billion in funds are directed to the Child Care & Development Block Grant program to help support child-care facilities, particularly in high-need areas. The bill expands eligibility for subsidies to purchase insurance to people of all incomes and caps the maximum premium at 8.5% of a person’s income. It also takes steps to lower, or even zero out, premiums for people making less than 150% of the federal poverty line.

The bill also encourages states to expand Medicaid by having the federal government pay for new recipients. Twelve states have refused to broaden their Medicaid programs through the ACA, even though the federal government pays 90% of the costs. Employees who lose their jobs or lose benefits as a result of working fewer hours qualify for 100% Cobra health-insurance subsidies under the Senate plan, a boost from the 85% subsidy in the House-passed bill. |

| Schools and Higher Education | $178 billion | $130 billion to K-12 schools to help students return to the classroom. Schools can use monies to update their ventilation systems, reduce class sizes to help implement social distancing, buy personal protective equipment and hire support staff. It would require that schools use at least 20% of the money to address learning loss by providing extended days or summer school, for example. The money is also intended to help prevent teacher layoffs next year when some states may be struggling to balance their budgets. Also includes $1 billion for Head Start. $40 billion for colleges which would require them to spend at least half the money to provide emergency financial aid grants to students. Also, student loans forgiven between Dec. 31, 2020, and Jan. 1, 2026, will be tax-free. |

| Vaccines and Health Care | $176 billion | $14 billion vaccine distribution, $10 billion to use the authorities of the Defense Production Act to purchase, manufacture, and distribute critically-needed medical supplies and equipment, $50 billion into the Disaster Relief Fund to ramp up the national vaccination program,

$49 billion for COVID-19 testing, tracing, and genomic sequencing; $8 billion to strengthen the public health workforce; $11 billion for public health investments, such as expansion of community health centers and the National Health Service Corps; $6 billion for the Indian Health Service; and $35 billion to make the Affordable Care Act’s exchanges more affordable. |

| Small Business, Farmers, Restaurants and Bars, Transportation | $109 billion | $15 billion to the Emergency Injury Disaster Loan program (EIDL). $7 billion more for The Paycheck Protection Program (PPP), $25 billion for a new grant program specifically for bars and restaurants. The legislation sets aside $5 billion of the total money to be targeted to businesses with less than $500,000 in revenue in 2019. Transit agencies would get $28 billion in grants, and $11 billion would go to airports and aviation manufacturers. About $2 billion goes to Amtrak and other transit-related spending. $12 billion provides grants to airlines and contractors to freeze layoffs at airlines through September. $16 billion toward Farmers. |

| Renters and Homeowners | $40 billion | $19.1 billion to state and local government to help low income households cover back rent, rent assistance and utility bills. $10 billion to help struggling homeowners pay mortgages, utilities and property taxes. $5 billion to help states and localities assist those at risk of experiencing homelessness and more. |

Overall, the bill heavily funds healthcare and vaccine sourcing and delivery – to the tune of $176 billion; recovery efforts; and help for the lowest income families.

Health insurance subsidies and Medicaid will take up $35 billion in spending and specifically would make federal premium subsidies for Affordable Care Act policies more generous and would eliminate the maximum income cap for two years. The bill:

- Reduces health care premiums for low- and middle-income families by increasing the Affordable Care Act’s (ACA) premium tax credits for 2021 and 2022, according to a summary from the House Ways and Means Committee. It eliminates the existing income cap (400% of the poverty level) on who qualifies for subsidies, and lowers the maximum amount participants are expected to contribute to about 8.5% of their income, down from 10%.

- Spends $15 billion to provide a temporary five percentage-point increase in the federal Medicaid match to states that expand eligibility to lower-income adults. Could this be bait for the states that did not accept Obamacare? We shall see.

- Provides COBRA subsidies so workers who have been laid off or had their hours reduced hours can keep their doctors and health coverage. It also creates health care subsidies for unemployed workers who are ineligible for COBRA.

In addition, the tax credits for families are notable. The child tax credit was created in 1997 but currently leaves out a full third of all children from accessing the maximum benefit. Right now, the credit is tied to a family’s tax burden. What this means is that those who have no tax liability after deductions are not eligible. About 48 million families benefit from the credit, which phases out for single parents earning more than $200,000 or married couples earning more than $400,000. Removing the provision that ties the credit to tax liability makes it fully refundable. This means that families who owe $0 in taxes could still get the full child tax credit back. This potentially could help an estimated 27 million children in families that do not yet receive the full benefit, according to the Center on Budget and Policy Priorities. This provision alone may cut child poverty in half, according to the Center on Poverty and Social Policy at Columbia University.

Connecticut’s Congresswoman Representative Rosa DeLauro, my Congresswoman, deserves a moment of recognition here. For nearly 20 years, DeLauro, a 16th term Congresswoman, and newly appointed chair of the House Appropriations Committee, has been taking every opportunity to promote extending the child tax credit. She has been a lone proponent of its expansion until recently and has also garnered support from Republicans such as Senators Mike Lee, Marco Rubio and Mitt Romney.

So overall, this is a very expensive bill with some bold efforts included. But if it works as intended, the pay-off and pay-back could very well be worth it and provide economic benefits for lower income Americans for years to come.

Watch Charlotte Walker’s Discussion With Dr Naomi Wolf HERE