Opinion: “Australia’s Superannuation Calamity”

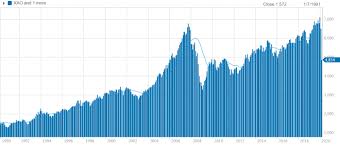

Australia’s superannuation guarantee has left Australian workers behind, frozen at 2014 rates. The Morrison government insists, now is not the time to be renewing the superannuation guarantee rate of Australian workers, in the midst of the Covid-19 pandemic and recession. Despite the obvious benefits of increased production and employee well-being, the government claims it will adversely affect wage growth & burden employers. Former Prime Minister Paul Keating has not been backward in condemning the governments’ planned changes to superannuation and the importance of superannuation entitlements to beneficiaries and taxable components. Federal Treasurer Frydenberg would prefer Australian workers, use their voluntary savings to purchase a house, ahead of raising compulsory superannuation contributions. Again, Paul Keating has been critical of the proposal.

Australian workers have not seen an increase in their employee superannuation, since the LNP government broke its’ election promise, in 2014 to increase their super rate. Instead, promising them wage rises. Superannuation Industry modelling shows that a freeze at the current rate of 9.5% of wages would be a fleeting win for the government, followed by snowballing pension costs, by the early 2040’s (https://www.theguardian.com/australia-news/2020/sep/10/freezing-super-guarantee-will-cost-federal-government-billions-in-future), casting doubt on the government’s claim they are good economic mangers.

At the last election, Australian Prime Minister Scott Morrison committed to continuing the scheduled increase in superannuation, from 9.5% to 12% by 2025. But again, the LNP government is planning to abolish the increase to the superannuation guarantee, asserting employers should not be burdened with higher employee superannuation costs, given the economic impact from the pandemic (https://www.theguardian.com/australia-news/2020/nov/19/coalition-paves-way-for-scrapping-planned-rise-in-superannuation-guarantee. Adding, a rise in the super guarantee will slow wage growth (https://mckellinstitute.org.au/research/articles/superandwages/.

But an Industry Super Australia analysis of 8,370 Enterprise Bargaining Agreements (EBAs) struck before and after the super rate was frozen, shows the promised wage increase never materialised and workers were not compensated for lost super. The rate was scheduled to rise to 10% on 1 July 2015 and by 0.5% each year thereafter until it reached 12% by 2019. Holding back the promised increase, could cost a full-time worker, in their 30s, $45,000 at retirement. In agreements certified after the super rate was cut, wage growth fell from 3.33% before the cut to 3.27%. Illustrating employers pocketed the lost super and a workers’ total remuneration also went backwards. The report confirms uncomfortable truths for Australians, most employers do not voluntarily return the loss of mandatory super payments as wages and workers were left worse off following the freeze on Super in 2014. History is repeating itself, with the Australian Government again proposing cutting the planned increase to the super guarantee. In favour of increasing wages and take – home pay.

(https://www.miragenews.com/no-magic-wage-rise-cutting-super-rate-left-workers-worse-off/).

On the plus side, records indicate higher wages do lead to higher productivity, as a 2015 study by the UK’s University of Warwick reported workers receiving higher wages, is they have more take home pay to spend in the economy, increasing the productivity of business (https://www.abc.net.au/news/2020-02-05/super-funds-could-be-key-to-boosting-your-pay/11928142). However, The Prices Wages and Labour Market Section claims an increase to super would erase 80 per cent of wage rises over four years. The Australian Institute of Superannuation Trustees has counterclaimed an unchanged superannuation rates will not present workers with an increase in wages.

Traditionally Australian policy makers have agreed, super contributions are paid for out of wages growth.”

(Superannuation cannot rise without stalling wage growth, RBA documents reveal – ABC News).

Treasurer Scott Morrison says to forget about relying on the age pension (smh.com.au).

The architect of superannuation former Prime Minister Paul Keating, has chastised the Government for breaking an election promise, hurting struggling Australians (https://www.9news.com.au/national/paul-keating-lashes-scott-morrison-government-over-superannuation-scheme/9ad13859-5e85-453c-97af-4e8c4ea69dc4).

An important reminder about superannuation, superannuation can only be passed on tax-free, when left to a spouse or dependent children under the age of 18. A death benefit dependent, as determined by the Tax Act, can also include de-factos, former spouses, those with whom you have shared an interdependency relationship immediately prior to death, and others who were financially dependent on you just before you died.

Beneficiaries who fall outside of these parameters, such as adult children, are often caught up in the ATO’s tax dragnet. Superannuation benefits are generally comprised of both taxable and tax-free funds, based on the nature of contributions that have been made over time. Those contributions made by your employer form part of the taxable component, while after-tax contributions made by you separately make up the tax-free component.

It’s the taxable component – usually where the bulk of an individual’s super funds reside – that will carry the sting for any adult children receiving your super payout on your death (Beware of the ATO’s superannuation death trap | The New Daily

Josh Frydenberg’s office ahead of the report’s official release on Friday put greater emphasis on Australians using “voluntary savings”, including equity within their homes, ahead of raising compulsory superannuation contributions

Speaking at a media conference in Sydney on Monday, Mr Keating said the decision to allow fund members to access their retirement savings to mitigate the economic effects of the pandemic, coupled with a proposed delay to the 12 per cent super guarantee. Is the equivalent to removing the plug from a bath full of water, to drain away, “Water in the bath is the savings, the government is taking the plug out of the bath,” he said.

“When they have already lost $40 billion [in early withdrawals… now they are turning the tap off at the top of the bath to stop the extra 2.5 per cent of super coming in. And they say, this is all because we have got a national emergency, and the economy can’t afford to pay this amount.”( Paul Keating accuses government of attempting to destroy superannuation (thenewdaily.com.au).

Who could blame Australian workers’ demand, the LNP government to uphold it electoral commitment to raising the superannuation guarantee? The government claim, wage growth will be restricted, by an increase in the superannuation guarantee have been disproved. Paul Keating has further criticised the government over its’ attitude towards superannuation and allowing Australian’s to withdraw their superannuation and prop up the economy, without a plan to bolster their superannuation accounts for retirement.