HB 5130 Protecting Consumers from Unreasonable Credit Rates Act of 2014

US Congress 113th Congress

Protecting Consumers from Unreasonable Credit Rates Act of 2014

HB-5130

About HB-5130

Protecting Consumers from Unreasonable Credit Rates Act of 2014 - Amends the Truth in Lending Act to prohibit a creditor from extending credit to a consumer under an open end consumer credit plan (credit card) for which the fee and interest rate exceeds 36%. Sets forth criminal penalties for violations of this Act. Empowers state Attorneys General to enforce this Act. Revises requirements for a periodic statement for each billing cycle with respect to where the total finance charge exceeds 50 cents for a monthly or longer billing cycle, or the pro rata part of 50 cents for a billing cycle shorter than monthly. Requires inclusion of the fee and interest rate, displayed as "FAIR," instead of the total finance charge expressed as an annual percentage rate (APR).

Bill Texts

Introduced 07/22/2014

Weigh In

No votes yet!

Cast yours now to be the first.

Spread the Word!

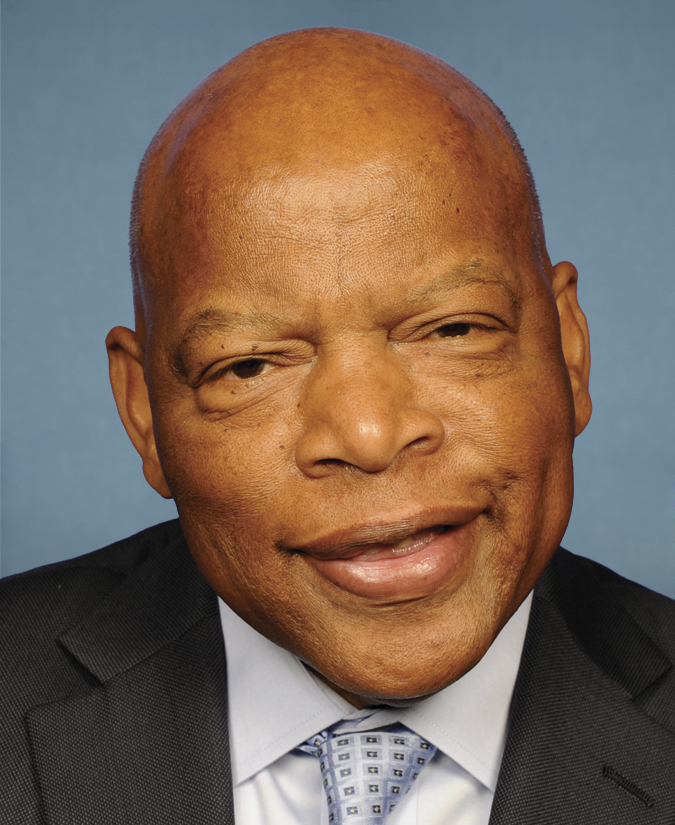

Sponsors (50)