HB 1020 Low Value Shipment Regulatory Modernization Act of 2013

US Congress 113th Congress

Low Value Shipment Regulatory Modernization Act of 2013

HB-1020

About HB-1020

Low Value Shipment Regulatory Modernization Act of 2013 - Expresses the sense of Congress that the United States Trade Representative (USTR) should encourage other countries, through bilateral, regional, and multilateral fora, to establish commercially meaningful de minimis values for express and postal shipments of articles that are exempt from customs duties and certain entry documentation requirements, as appropriate. Amends the Tariff Act of 1930 to increase from $200 to $800 for 2014, and to $800 adjusted annually for inflation after 2014, the aggregate retail value in the country of shipment of articles that may be imported duty-free into the United States by one person on one day.

Bill Texts

Introduced 03/12/2013

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

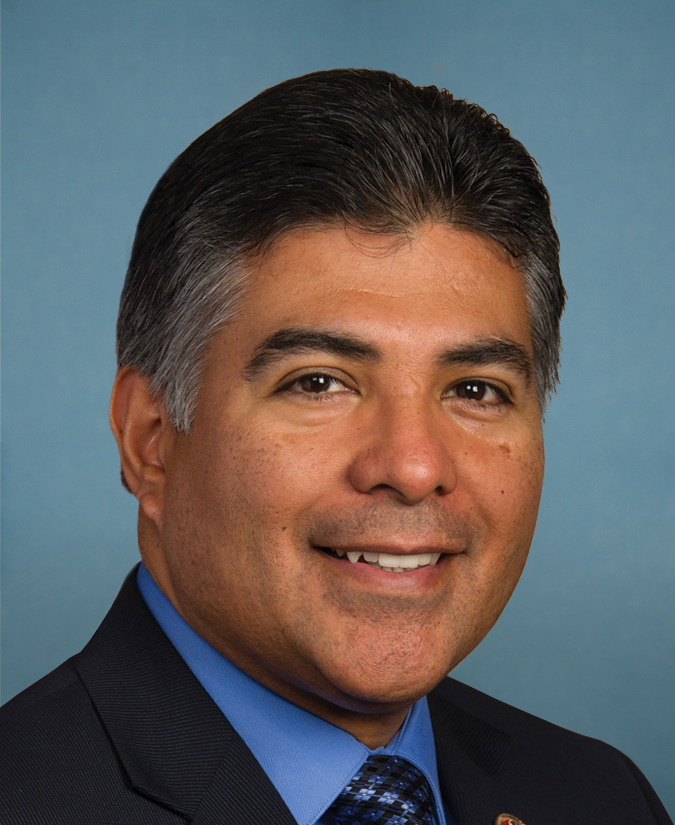

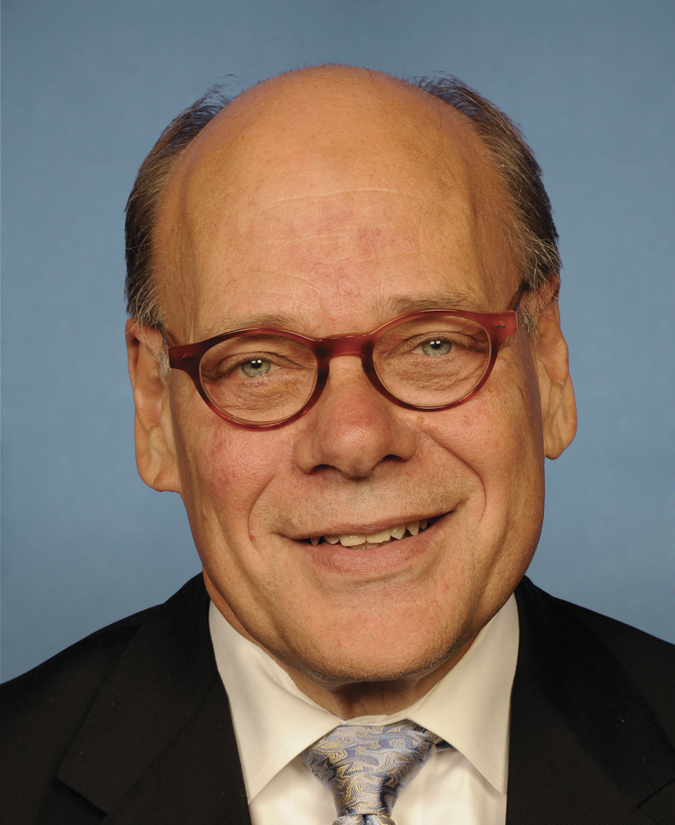

Sponsors (243)