HB 2024 Commercial Motor Vehicle Advanced Safety Technology Tax Act of 2009

US Congress 111th Congress

Commercial Motor Vehicle Advanced Safety Technology Tax Act of 2009

HB-2024

About HB-2024

Commercial Motor Vehicle Advanced Safety Technology Tax Act of 2009 - Amends the Internal Revenue Code to allow a general business tax credit for 50% of the cost of placing in service any qualified commercial vehicle advanced safety system. Defines "qualified commercial vehicle advanced safety system" as a manufacturer-certified brake stroke monitoring system, lane departure warning system, collision warning system, or vehicle stability system identified by the Federal Motor Carrier Safety Administration or the National Highway Traffic Safety Administration as significantly enhancing the safety or security of commercial drivers, vehicles, or passengers. Terminates such credit after 2014.

Bill Texts

Introduced 11/25/2010

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

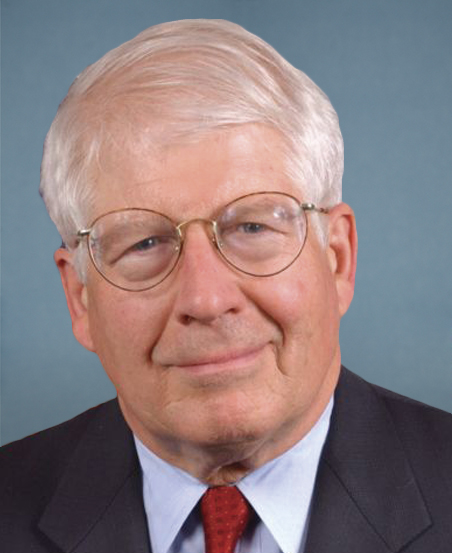

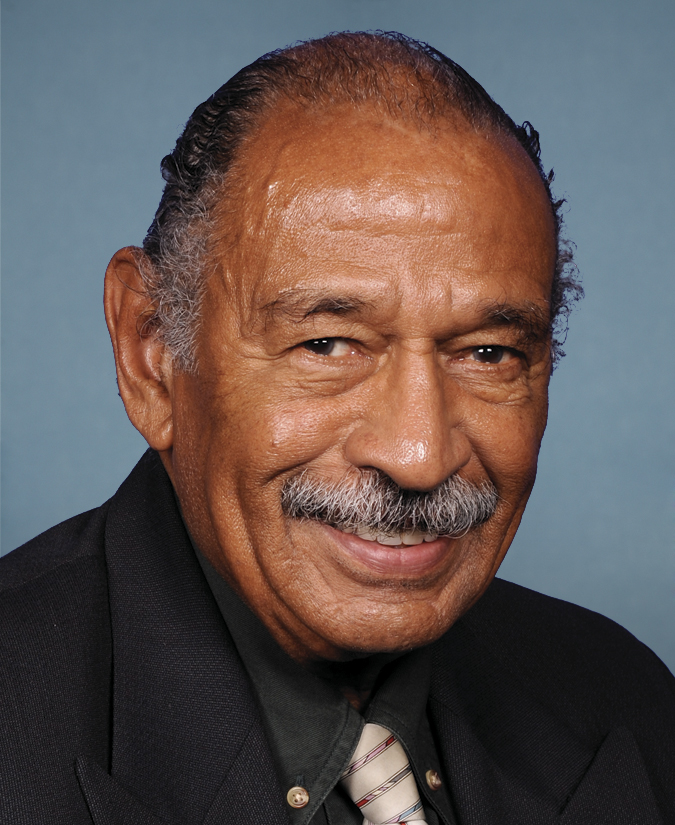

Sponsors (38)