HB 6579 To amend the Internal Revenue Code of 1986 to allow certain taxpayers a 2 year carryback of net operating losses and to restore and make permanent the limitation on excess business losses of non corporate taxpayers

US Congress 116th Congress

To amend the Internal Revenue Code of 1986 to allow certain taxpayers a 2-year carryback of net operating losses and to restore and make permanent the limitation on excess business losses of non-corporate taxpayers.

HB-6579

About HB-6579

Makes permanent the limitation on excess business losses of noncorporate taxpayers and allows certain taxpayers a two-year carryback of net operating losses arising in 2020.

Bill Texts

Introduced 04/25/2020

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

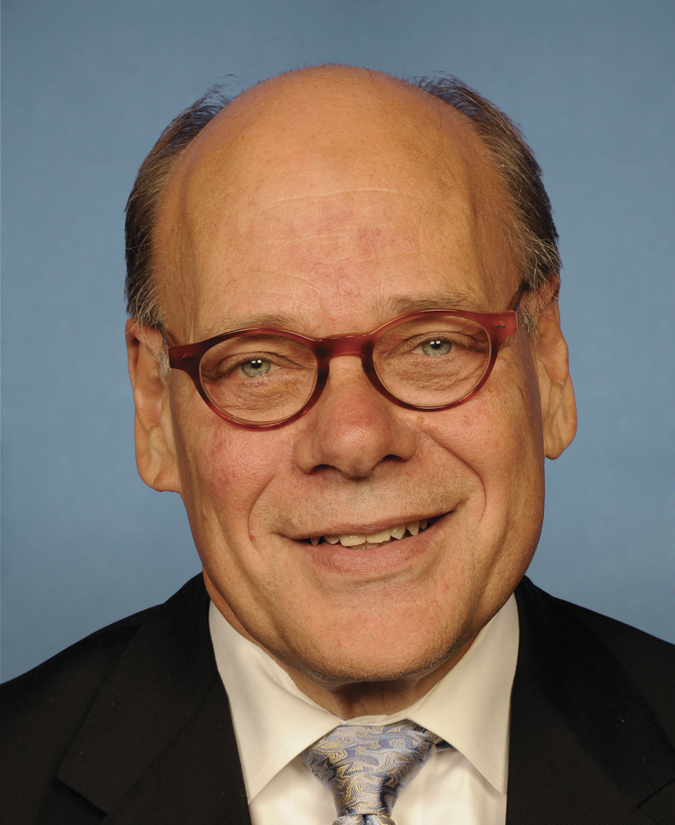

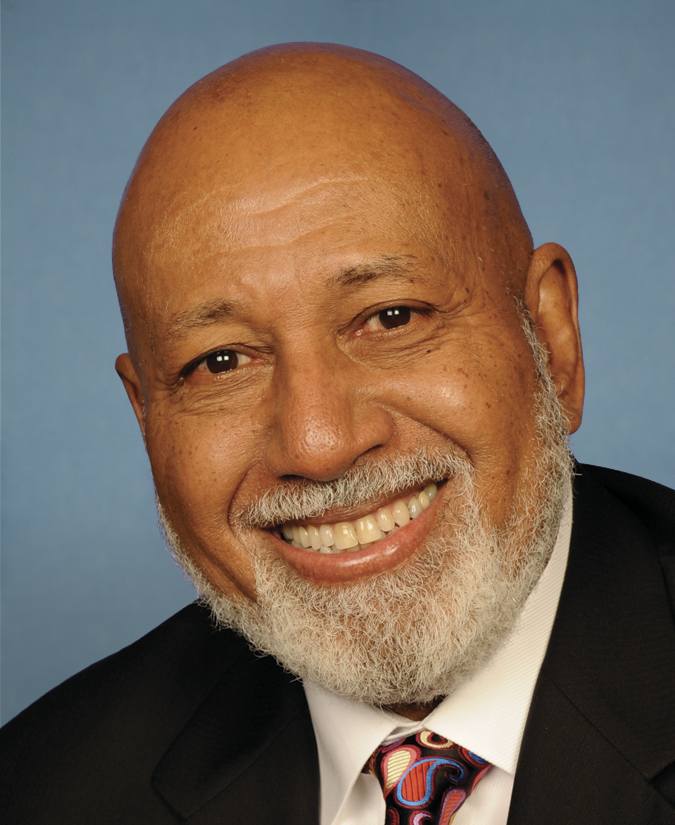

Sponsors (57)