S 2996 FAIR Energy Policy Act Fossil Aid is Inefficient and Regressive Energy Policy Act

US Congress 114th Congress

FAIR Energy Policy Act Fossil Aid is Inefficient and Regressive Energy Policy Act

S.2996

About S.2996

FAIR Energy Policy Act Fossil Aid is Inefficient and Regressive Energy Policy Act This bill amends the Internal Revenue Code to phase out certain tax provisions that apply to fossil fuels. The bill establishes a schedule for decreasing the benefits of the provisions for major integrated oil companies by specified percentages that reach 100% after December 31, 2019. The affected provisions include: the deduction for intangible drilling costs, the deduction for the percentage of depletion of oil and natural gas wells, the deduction for oil related qualified production activities income, the deduction for the amortization of geological and geophysical expenditures, the deduction for the percentage of depletion of oil shale, the deduction for exploration and development costs for oil shale, the capital gains treatment for royalties of coal, the deduction for tertiary injectants, the exception to the passive loss limitation for working interests in oil and natural gas properties, and the marginal wells tax credit.

Bill Texts

Introduced 06/03/2016

Weigh In

No votes yet!

Cast yours now to be the first.

Spread the Word!

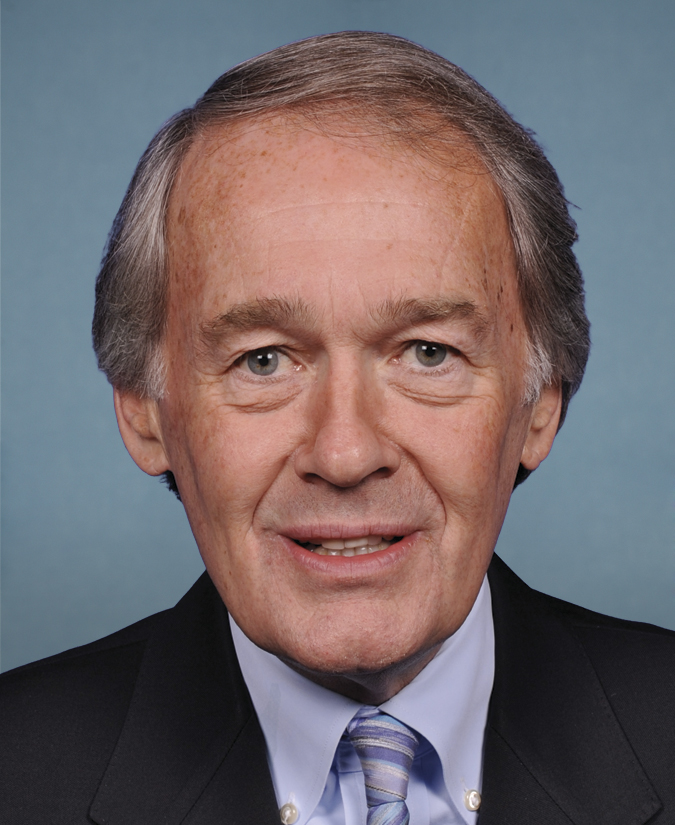

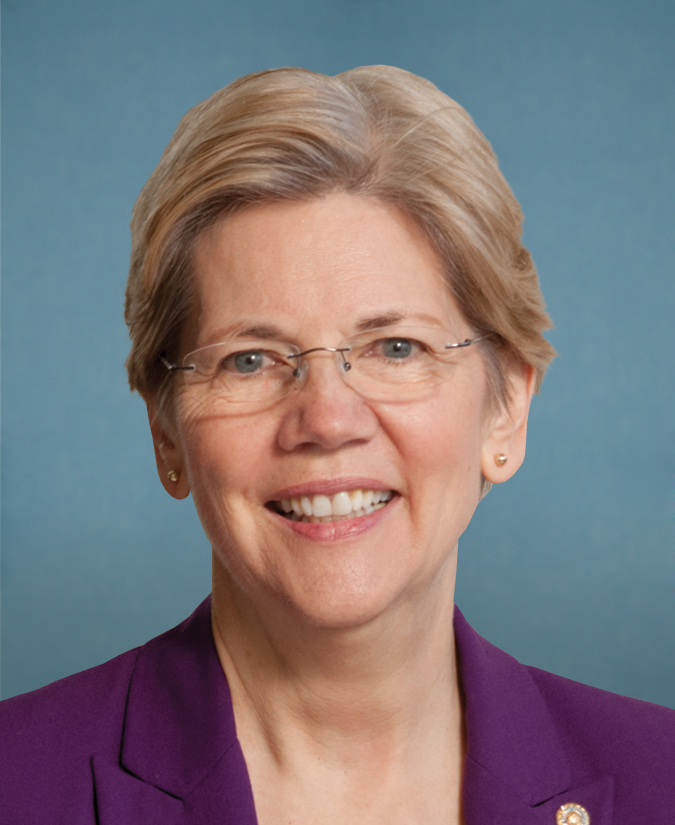

Sponsors (7)