S 378 Stop Price Gouging Act

US Congress 116th Congress

Loading body...

Bill Texts

Introduced 02/25/2019

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

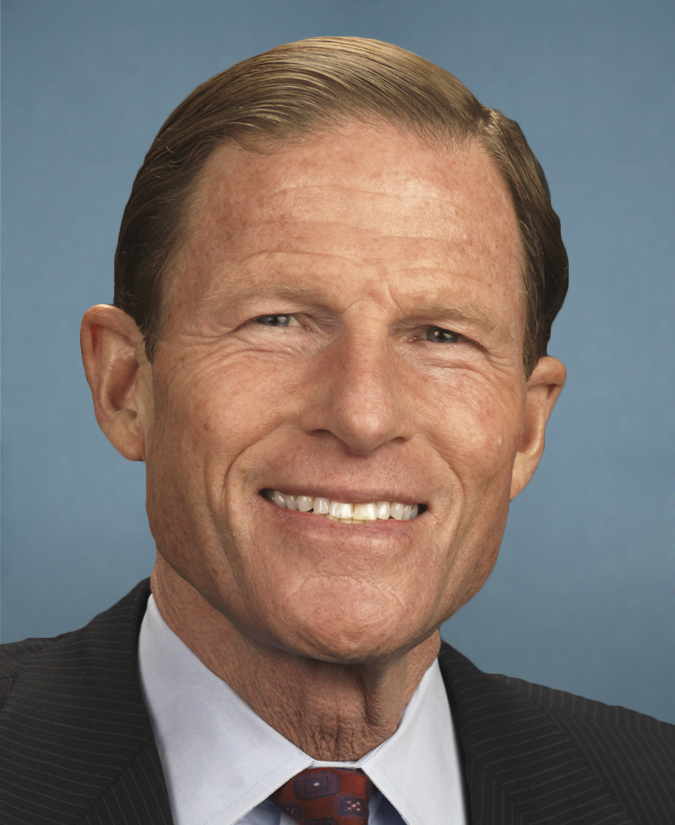

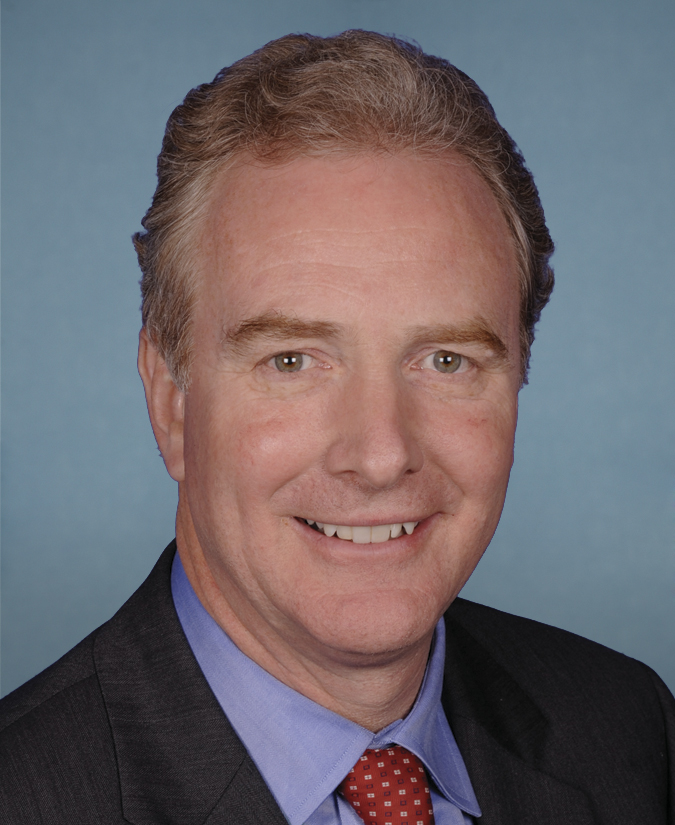

Sponsors (6)