S 2976 Advancing Support for Working Families Act

US Congress 116th Congress

Advancing Support for Working Families Act

S.2976

About S.2976

Allows individual taxpayers an election to advance up to $5,000 of the child tax credit in the year of birth or adoption of an applicable qualifying child (a child, other than an eligible foster child, who has a specified relationship to the taxpayer and meets certain age, residency, and support requirements). The bill sets forth a special rule for parents who do not qualify for the full refundable portion of the child tax credit. The advance amount for such parents is the lesser of $5,000, or 25% of their earned income amount for the taxable year. The bill requires the Government Accountability Office to report to Congress on matters relating to taxpayers who make an election to advance the child tax credit.

Bill Texts

Introduced 12/13/2019

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

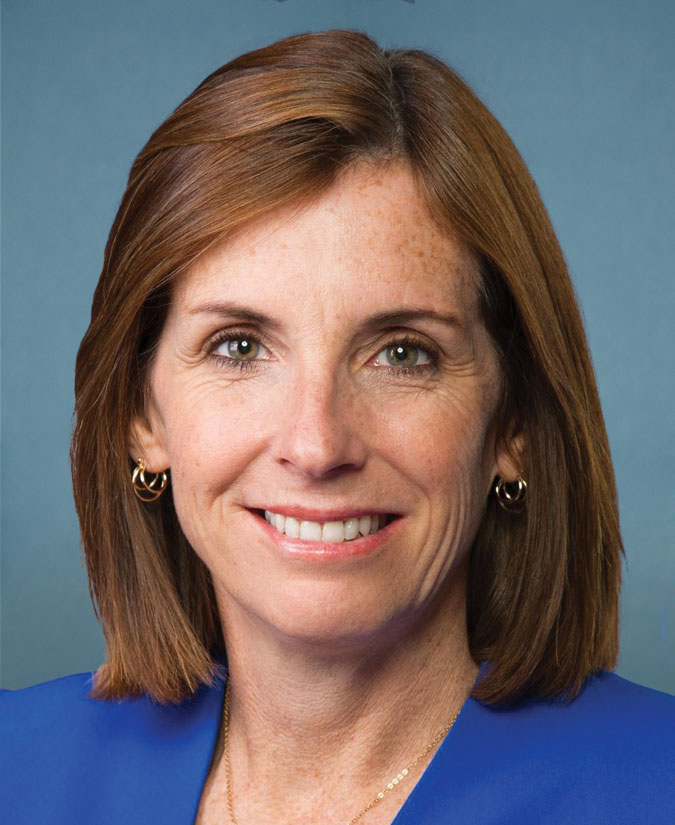

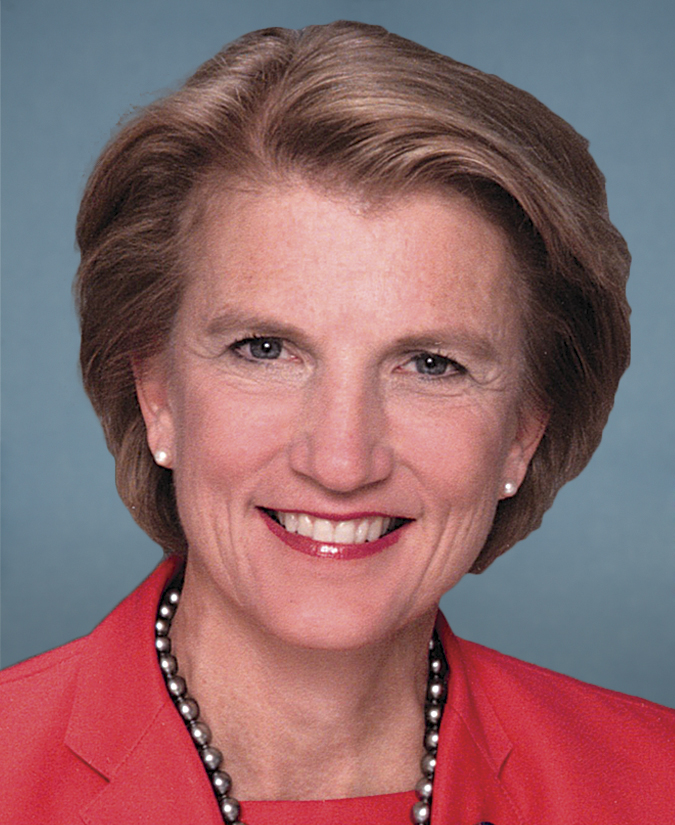

Sponsors (7)