HB 8032 Health Savings Accounts For All Act of 2020

US Congress 116th Congress

Health Savings Accounts For All Act of 2020

HB-8032

About HB-8032

Revises provisions relating to health savings accounts (HSAs). Specifically, the bill repeals the annual limitation on tax-deductible contributions to HSAs by plan participants and their employers; eliminates the requirement that an HSA participant must be enrolled in a high deductible health plan as a condition of eligibility; expands qualified medical expenses to include prescription and over-the-counter drugs; allows payments from HSAs for health insurance premiums; allows payment of medical expenses incurred prior to the establishment of an HSA and correction of administrative errors prior to the due date of an applicable tax return; allows a tax-free rollover of amounts in an HSA, upon the death of an account holder, to the account holder's child, parent, or grandparent; and extends bankruptcy protections to HSAs on the same basis as tax-preferred retirement plans.

Bill Texts

Introduced 09/03/2020

Weigh In

No votes yet!

Cast yours now to be the first.

Spread the Word!

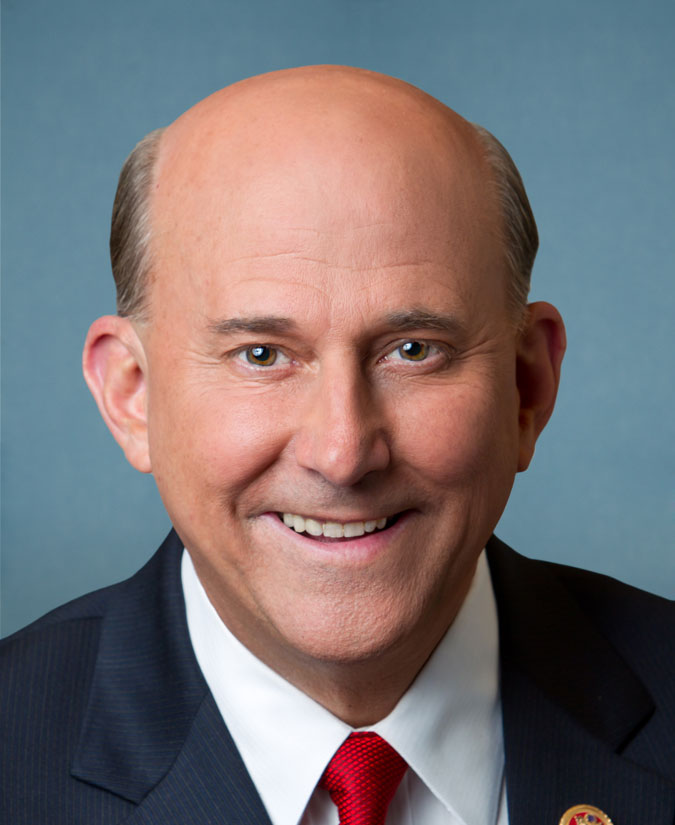

Sponsors (14)