S 53 WALL Act of 2019

US Congress 116th Congress

WALL Act of 2019

S.53

About S.53

Appropriates $25 billion for the construction of a wall on the U.S.-Mexico border. The amount shall remain available until expended. As offsets to the spending, this bill restricts the child tax credit, earned income credits, and lifetime learning credits to those with social security numbers and not prohibited from employment in the United States. Also, individuals who file taxes using an individual taxpayer identification number (ITIN) instead of a social security number shall pay a fee ($300 times the number of persons on the tax return issued an ITIN). The bill restricts eligibility for certain federally-funded benefits, including unemployment compensation, supplemental nutrition assistance, and housing benefits, to those with eligibility to work in the United States. Agencies administering such benefits shall use the E-Verify program to confirm the eligibility of applicants for such benefits. also sets fines for aliens who improperly enter the United States or overstay their visas.

Bill Texts

Introduced 01/17/2019

Weigh In

No votes yet!

Cast yours now to be the first.

Spread the Word!

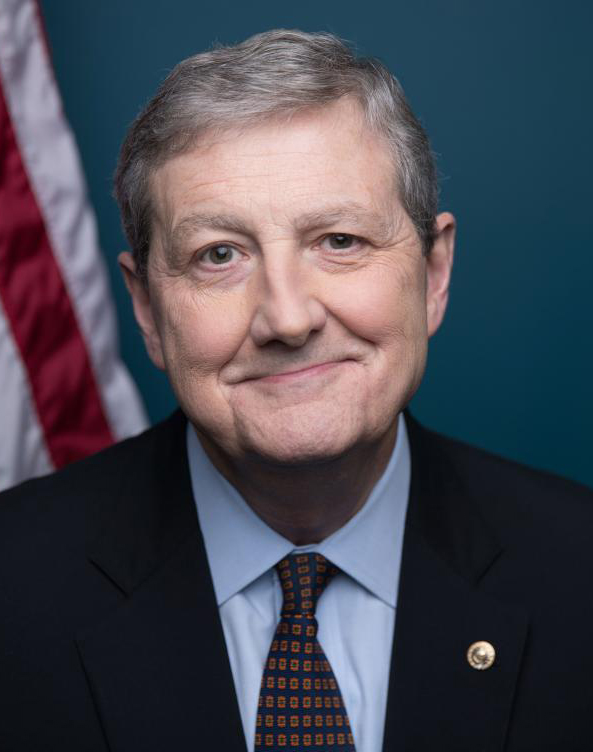

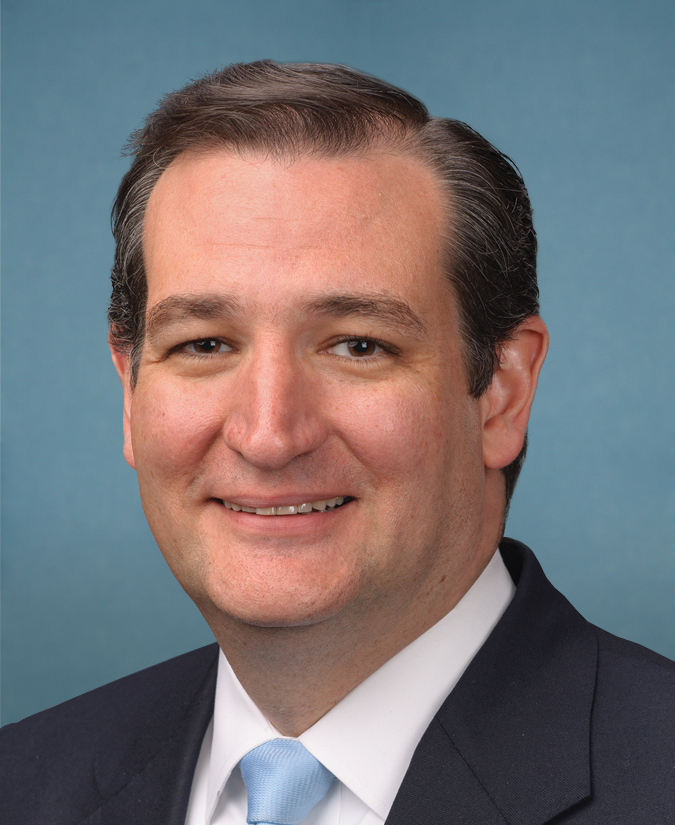

Sponsors (6)