HB 3207 To amend the Internal Revenue Code of 1986 to exclude from gross income gain on the sale of certain residential leased fee interests to holders of the leasehold rights

US Congress 111th Congress

To amend the Internal Revenue Code of 1986 to exclude from gross income gain on the sale of certain residential leased-fee interests to holders of the leasehold rights.

HB-3207

About HB-3207

Amends the Internal Revenue Code to exclude from gross income gain from the sale of certain residential leased-fee interests to a holder of the leasehold right if such holder is:

- (1) an association of apartment owners of a multi-family residential leasehold property; or

- (2) a cooperative housing corporation for a residential leasehold property

Terminates such exclusion after 2014.

Bill Texts

Introduced 11/27/2010

Weigh In

No votes yet!

Cast yours now to be the first.

Votes for: 0 Votes against: 0

Spread the Word!

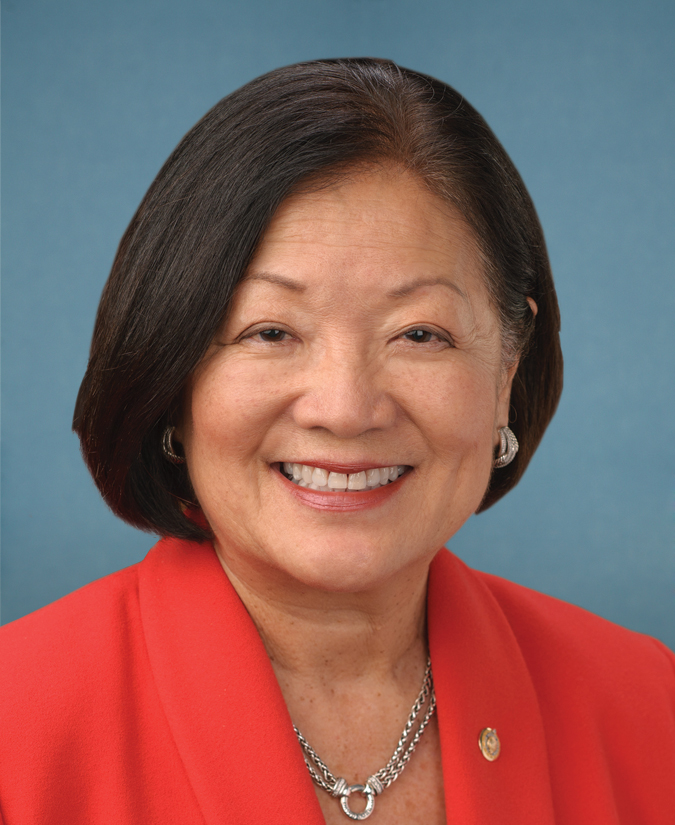

Sponsors (2)