S 4145 Preventing Foreign Interference in American Elections Act

US Congress 118th Congress

Preventing Foreign Interference in American Elections Act

S.4145

About S.4145

A bill to amend the Federal Election Campaign Act of 1971 to further restrict contributions of foreign nationals, and for other purposes.

S.4145: Preventing Foreign Interference in American Elections Act

S. 4145: Preventing Foreign Interference in American Elections Act

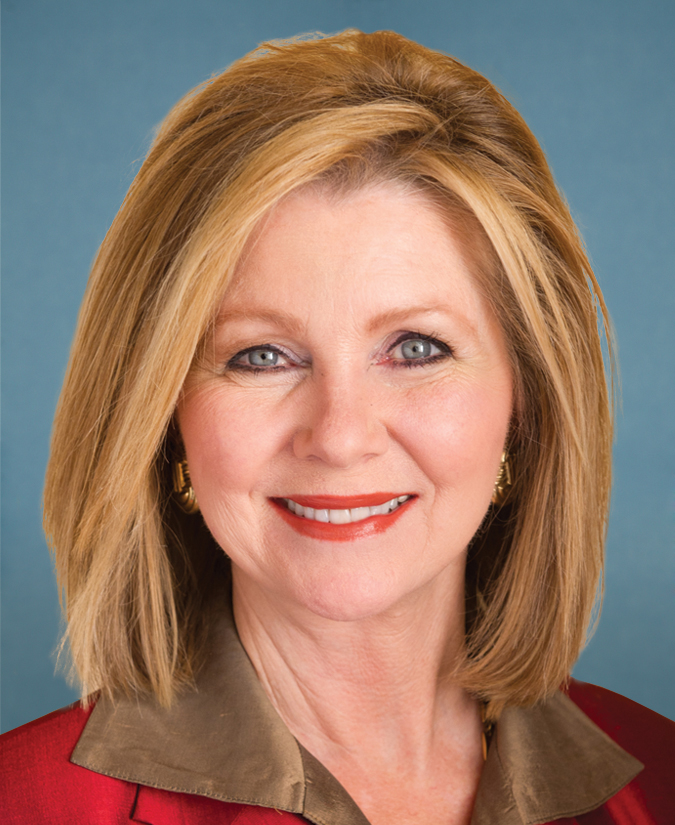

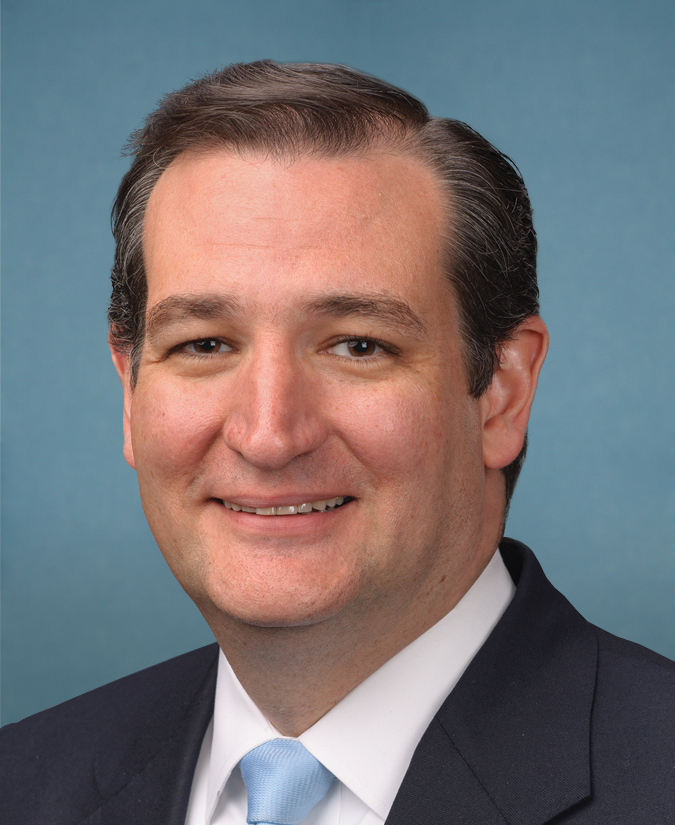

This bill, introduced by Mr. H AGERTY (for himself, Mrs. B LACKBURN , Mr. B UDD, Ms. L UMMIS , Mr. MARSHALL , and Mr. C RUZ), aims to amend the Federal Election Campaign Act of 1971 to further restrict contributions of foreign nationals and for other purposes. The bill proposes several modifications and restrictions to the use of foreign money in elections.

Section 1 of the bill states the short title as the "Preventing Foreign Interference in American Elections Act".

Section 2 of the bill makes modifications to the ban on foreign money contributions. It includes additional restrictions on contributions related to voter registration activity, ballot collection, voter identification, get-out-the-vote activity, public communication referring to political parties, and the administration of elections. It also updates the conforming amendment to reflect these changes.

Section 2(b) specifies that the restrictions outlined in Section 2 also apply to state and local elections, ballot initiatives, referenda, and recall elections.

Section 2(c) prohibits any person from knowingly aiding or facilitating a violation of the restrictions outlined in Section 2.

Section 2(d) clarifies that a person can be treated as indirectly making a contribution, donation, expenditure, or disbursement if they contribute to another person with the result that their contribution is used for an activity described in Section 2(a).

Section 2(e) provides enforcement provisions, giving individuals the opportunity to submit a certification under perjury to dispute any allegations of violation. It also limits investigations of alleged violations to only consider factual matter necessary to determine if the violation occurred.

Section 3 of the bill aims to protect the privacy of donors to tax-exempt organizations. It restricts the collection and disclosure of donor information by entities of the federal government, with exceptions for the Internal Revenue Service, the Secretary of the Senate and the Clerk of the House of Representatives, the Federal Election Commission, and court or administrative body orders.

The bill defines a tax-exempt organization as one described in section 501(c) of the Internal Revenue Code of 1986 and exempt from taxation under section 501(a) of the same code. It also establishes penalties for the willful disclosure of donor information, including fines and imprisonment.

Bill Texts

Introduced 04/30/2024

Spread the Word!

Sponsors (6)

Track This Bill

Sponsors by party

History

Read Twice And Referred To The Committee On Rules And Administration.

04/17/2024Subject(s)