HB 3582 Pro Growth Budgeting Act of 2012

US Congress 112th Congress

Pro-Growth Budgeting Act of 2012

HB-3582

About HB-3582

Pro-Growth Budgeting Act of 2012 -

Back to top

Section 2

Amends the Congressional Budget Act of 1974 (CBA) to require the Congressional Budget Office (CBO) to prepare for each major bill or resolution reported by any congressional committee (except the congressional appropriations committees), as a supplement to CBO cost estimates, a macroeconomic impact analysis of the budgetary effects of such legislation for the 10-fiscal year period beginning with the first fiscal year for which such estimate was prepared and each of the next three 10-fiscal year periods. Defines "major bill or resolution" as any bill or resolution whose budgetary effects, for any fiscal year in the period for which a CBO cost estimate is prepared, is estimated to be greater than .25% of the current projected U.S. gross domestic product (GDP) for that fiscal year. Requires the analysis to describe:

- (1) the potential economic impact of the bill or resolution on major economic variables, including real GDP, business investment, the capital stock, employment, interest rates, and labor supply; and

- (2) the potential fiscal effects of the measure, including any estimates of revenue increases or decreases resulting from changes in GDP

Requires the analysis (or a technical appendix to it) to specify the economic and econometric models used, sources of data, relevant data transformations, as well as any explanation necessary to make the models comprehensible to academic and public policy analysts.

Back to top

Section 3

Amends CBA to require the CBO Director, after the President's budget submission and in addition to the baseline projections, to report a supplemental projection to the congressional budget committees, assuming extension of current tax policy for the fiscal year commencing on October 1 of that year, with a supplemental projection for the 10-fiscal year period beginning with that fiscal year, again assuming the extension of current tax policy. Defines "current tax policy" as the tax policy in statute as of December 31 of the current year, assuming:

- (1) the budgetary effects of measures extending the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Tax Relief Reconciliation Act of 2003;

- (2) the continued application of the alternative minimum tax (AMT) as in effect for taxable years beginning in 2011, with a specified assumption for taxable years beginning after 2011; and

- (3) the budgetary effects of extending the estate, gift, and generation-skipping transfer tax provisions of title III of the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010

Requires CBO to report to such committees, on or before July 1 of each year, the Long-Term Budget Outlook for:

- (1) the fiscal year commencing on October 1 of that year, and

- (2) at least the ensuing 40 fiscal years.

Bill Texts

Engrossed 02/04/2012

Introduced 01/31/2012

Introduced 12/13/2011

Weigh In

No votes yet!

Cast yours now to be the first.

Spread the Word!

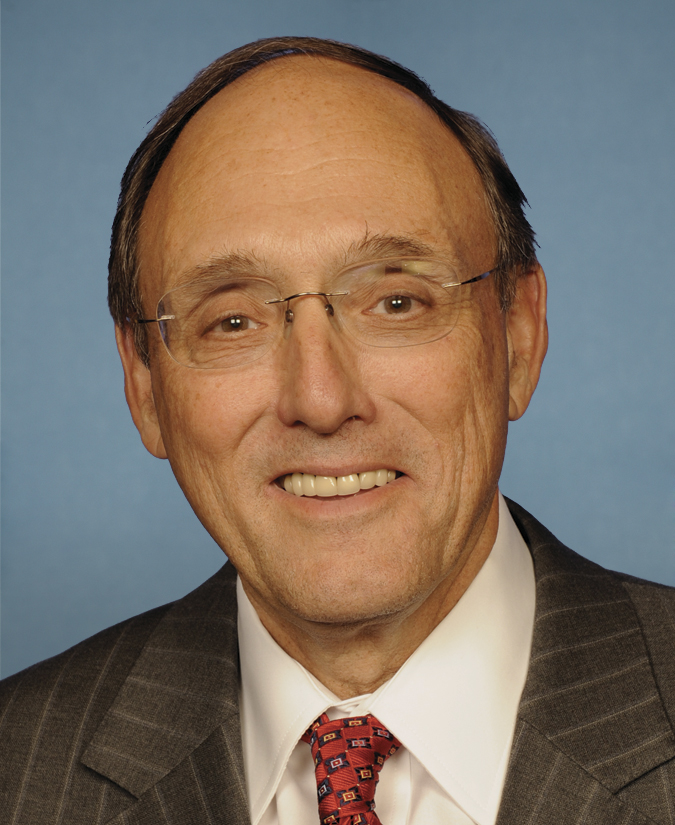

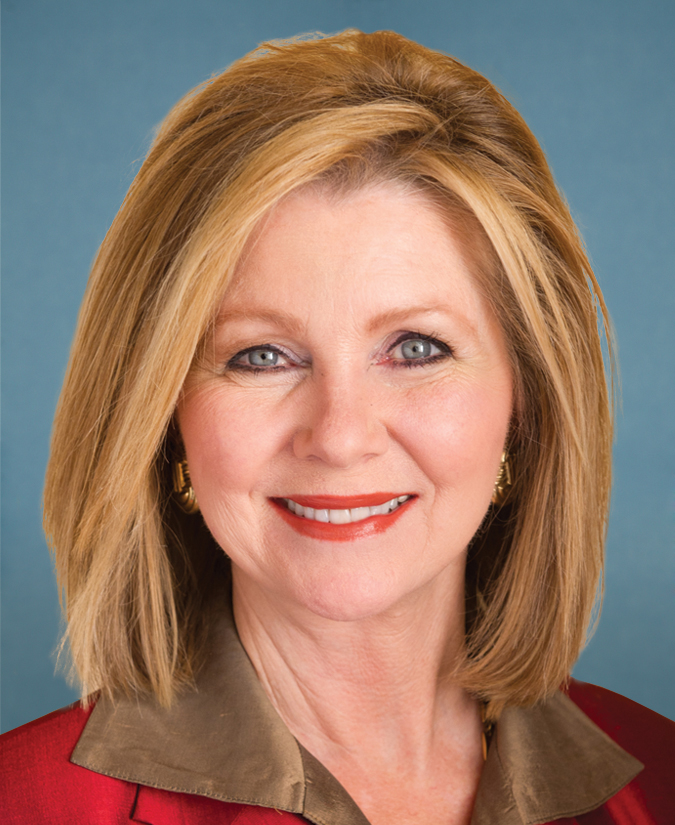

Sponsors (67)