HB 2927 Border Tax Equity Act of 2009

US Congress 111th Congress

Border Tax Equity Act of 2009

HB-2927

About HB-2927

Border Tax Equity Act of 2009 - Requires the United States Trade Representative (USTR) to certify to Congress whether or not U.S. objectives for revision of World Trade Organization (WTO) rules on border tax treatment of goods and services from countries with indirect tax systems have been met in WTO negotiations. Amends the Internal Revenue Code to impose a tax on imports of goods and services from any foreign country that employs an indirect tax system and grants rebates of indirect taxes paid on goods or services exported from that country. Requires deposit of such taxes into a special account. Requires the Secretary of Homeland Security (DHS), acting through the Commissioner responsible for the Bureau of Customs and Border Protection, upon request of a U.S. exporter, to grant a rebate from this special account to an exporter of goods or services from the United States to such a foreign country of the equivalent of any indirect taxes the foreign country imposes or applies to such goods and services at its border, with certain adjustments.

Bill Texts

Introduced 11/25/2010

Weigh In

No votes yet!

Cast yours now to be the first.

Spread the Word!

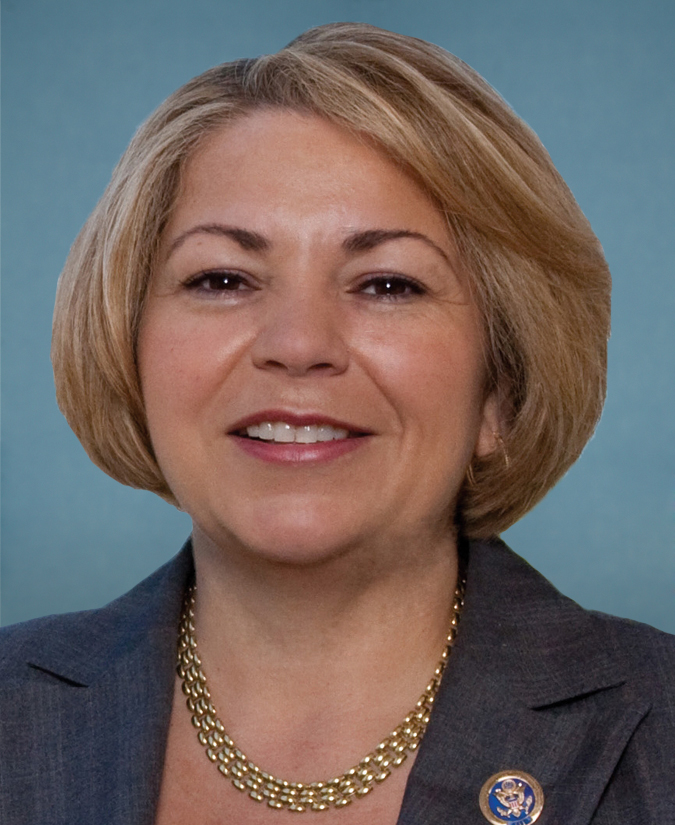

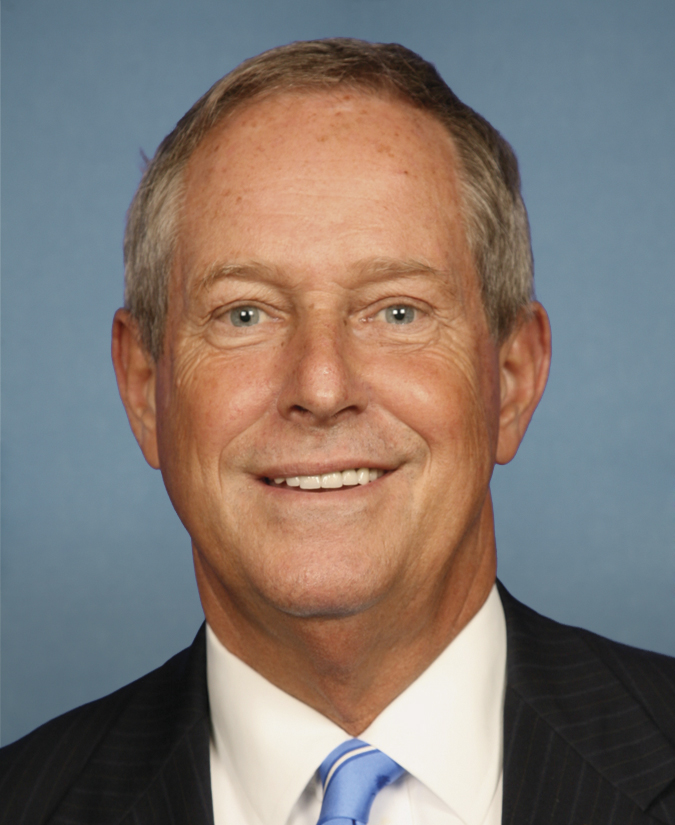

Sponsors (10)